A commonly traded rule in trading M&A is the clause that provides for the buyer's right to compensation, applicable, among other situations, in relation to liabilities of the target company whose existence is based on some past event, prior to the closing of the deal. This clause aims to limit the liability of the parties involved in the transaction for losses related to the company or the traded asset and can be structured in different ways.

A recent decision by the Court of Justice of the State of São Paulo (TJSP) highlighted the importance of expressly regulating this type of clause in M&A contracts. In this specific case, a share purchase and sale contract which represented 26,05% of the share capital of a limited company (hereinafter it will be referred to as the “contract”). According to this document, buyers would pay part of the price in cash and the other, by paying off the seller's debts to the company and other partners.

After completing the transaction, the buyers were obliged to make a contribution to the company, to cover part of the debt arising from a relevant labor action that already existed at the time the contract was signed. For this reason, the buyers filed a compensation action against the seller, requesting reimbursement for the contribution made, alleging that they were not aware of the existence of the labor action.

In his reasoning, the judge highlighted that it would be up to the buyers to check the existence of ongoing actions involving the company, taking into account the duty of diligence inherent to legal transactions of a corporate nature. On the other hand, he highlighted that it was up to the seller to have informed buyers about the existence of the action. With this, he stated that there was concurrent fault between the parties and ordered the reimbursement, by the seller, of 50% of the amounts contributed to the company by the buyers with the aim of paying the debt. In its decision, the TJSP upheld the sentence and highlighted that the decision also resulted from the absence of an indemnity clause delimiting the parties' liability.

How indemnification clauses work in M&As

In the case mentioned, the signing (signing of the quota purchase and sale contract) and the closing (closing of the transaction, with payment of the price in cash and transfer of the quotas)¹ occurred in the same act². Based on this case, it is possible to understand the functioning and main objective of indemnity clauses, which is to define which party (buyer or seller) will be responsible for the losses materialized after the closing of the transaction (at which point the buyer will have already assumed the ownership of the assets), but which have triggering events prior to closing (at which time the assets still belonged to the seller).

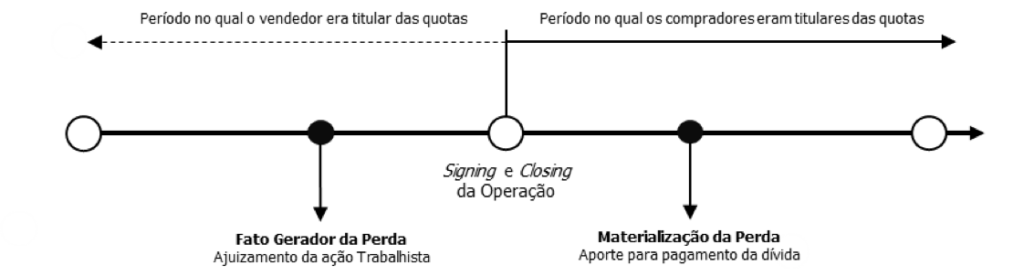

The timeline below illustrates, chronologically, the occurrence of the triggering event (irregular labor practices by society that led to the filing of the labor action and the respective conviction) and the materialization of the loss (contribution to society to pay the labor debt):

It is noted that the filing of the labor action (and the irregular practices) occurred before the closing of the transaction (when the seller still owned the shares), but the loss (contribution to pay the debt) materialized after the closing of the transaction ( when the buyers already owned the shares). In these cases, it is common for indemnity clauses to establish that the seller will compensate the buyer, as the event that generated the loss occurred when the seller owned the shares and was still subject to business risks.

Risk allocation in mergers and acquisitions

However, the absence of an indemnity clause expressly defining the parties' liability gave rise to a legal dispute, the decision of which ended up dividing the burden of loss between the parties on the grounds of the existence of concurrent fault. This case exemplifies the importance of clearly establishing compensation rules, avoiding conflicts, giving greater predictability to the parties and preventing a business decision from being taken by the Judiciary (or by an arbitration chamber).

It is worth noting that there is a wide variety of indemnity clauses, giving entrepreneurs ample scope to allocate risks in the way they prefer. Normally, the choice for one or another form of indemnity clause involves weighing the risks and benefits assumed by the parties: the more liabilities are already reflected in the negotiated price, the less protective the indemnity clause will be for the buyer³.

Types of indemnity clause in M&As

The indemnity clause that generates the least protection for the buyer is drawn up when the transaction is structured as a “closed door”, in which the buyer exempts the seller from all risks arising from past liabilities and contingencies, regardless of whether or not they were revealed, except for compensation for non-compliance with obligations assumed by the seller in the contract. The indemnity clause that generates the greatest protection for the buyer is the complete indemnity clause, which provides that the seller will compensate the buyer for losses that occur prior to the closing of the transaction (as per the example above), including the so-called clause sandbagging — it establishes that the buyer's knowledge of a certain liability will not exempt the seller from paying compensation in the event of the liability materializing.

If the contract in the case judged by the TJSP had a “closed door” clause, the buyers would have to fully bear the loss resulting from the labor demand, even if it had triggering events prior to the transfer of the quotas to the buyers. If the parties had used the full indemnity clause, the sellers would have had to compensate the buyers, as the event giving rise to the loss occurred when the shares were still owned by them.

In addition to these and other variations, there are limitations to the duty to indemnify that can be inserted in indemnity clauses. The most used limitations in M&A operations are4: the maximum value limitation (cap), which establishes a ceiling value for the obligation to compensate; de minimis, which excludes individually irrelevant amounts from compensation; basket, which conditions the obligation to compensate on the accumulation of a certain amount; and temporal limitation, which limits the obligation to compensate for a determined period after closing the transaction. Careful analysis of these mechanisms and limitations on the right to compensation is fundamental for an M&A transaction and plays a crucial role in allocating risks between buyer and seller.

Source: Legislation & Markets (Open Capital)

¹The contract provided for the signing of the amendment to the company's articles of association, which would formalize the transfer of shares, at a time after the signing of the contract, but the obligation to transfer the shares already became enforceable at the time of signing the contract.

²Signing contracts together with the closing of the transaction is common in less complex transactions that are not subject to suspensive conditions and, therefore, do not require measures prior to the effective payment of the price and transfer of assets (such as, for example, approval from regulatory bodies).

³FERRAZ, Adriano Augusto Teixeira; FREITAS, Bernardo Vianna; SOUZA, Rodrigo Amaral. Risk allocation in M&A operations: analysis of price adjustment and indemnity clauses. In: BARBOSA, Henrique; BOTREL, Sérgio (coordination); New Law Themes and Corporate Finance. Belo Horizonte: Latin Quarter, 2019.

4FERRAZ, Adriano Augusto Teixeira; MOREIRA, Amanda Santos Sette Câmara. Clauses limiting the obligation to compensate in M&A transactions. In: GONTIJO, Bruno Mirada; VERSIANI, Fernanda Vale; CRUZ (coordination); João Vitor O. da Costa; PENNA, Thomaz Murta e (org.). Corporate Law and Capital Markets. Belo Horizonte: Editora D'Plácido, 2018.